how to calculate cost of stock

Calculate the ERP Equity Risk Premium ERP E Rm Rf. Closing stock Cost of sales profit and loss account Opening stock Stock purchases.

How to Calculate Cost Basis for Old Stock.

. Find the RFR risk-free rate of the market. Evaluating Stock Performance This calculation is the first step in using the average cost basis method for determining gains. If the company splits its shares this will affect your cost basis per share but not thTake the original investment amount 10000 and divide it by the new number.

To calculate your profits for tax purposes youll need to subtract your cost basis for the five shares from the sale price of the five shares. This metric is important because it gives. Book value per share Stockholders equity Total number of outstanding common stock For.

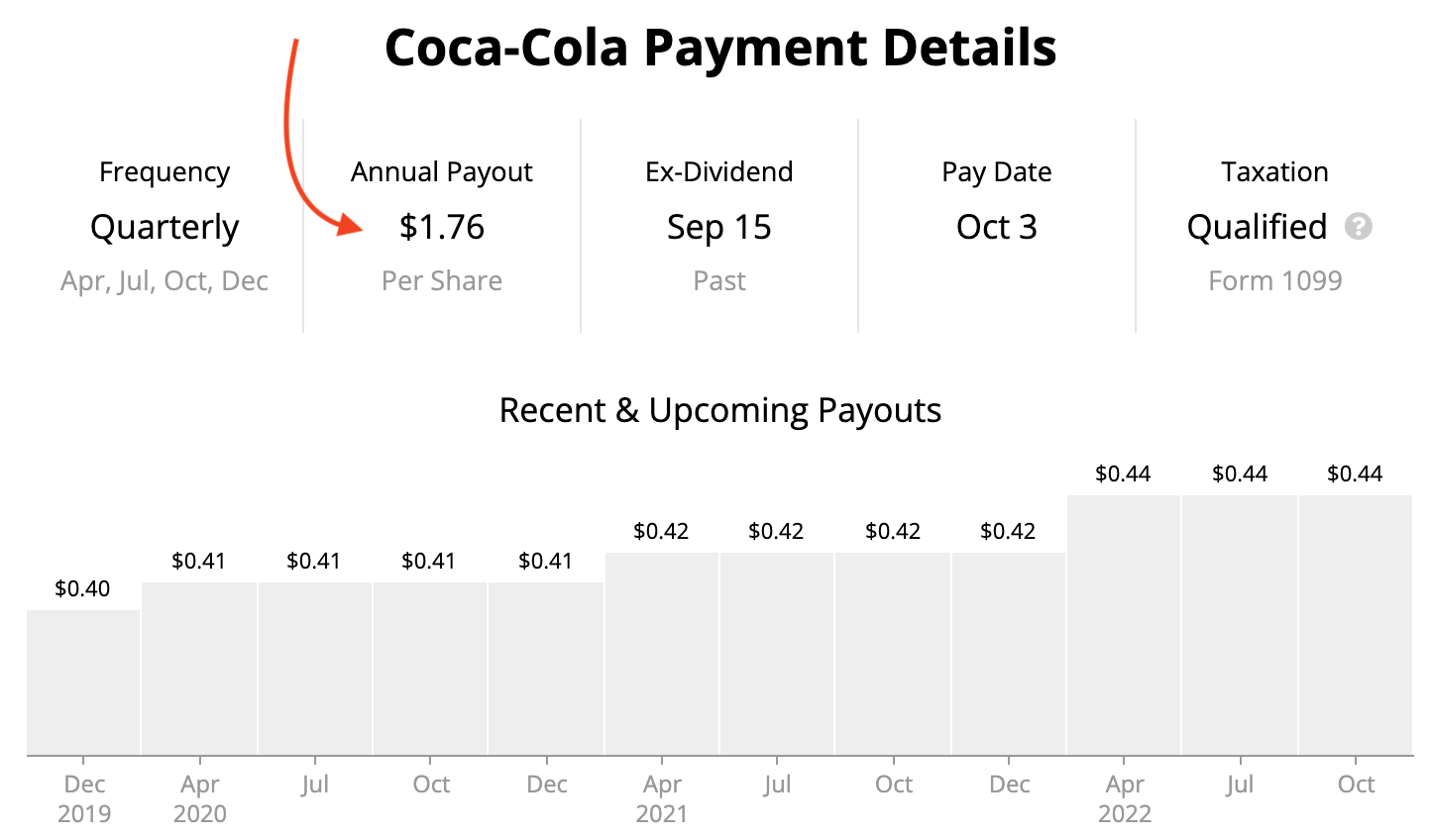

The formula for calculating the book value per share of common stock is. Dividing 4100 by 100 yields an average cost per share of 41. Purchase Cost Purchases 5122220 We shall take the total raw material and labor cost for raw material as purchase cost which is 3233230.

See also Easiest Methods of How to Solve X Like A Professional Example 1. Take your previous cost basis per share 10 and divide it by the split factor of 21 However if the companys share price has fallen to 5 and you want to i See more. Calculating the cost of stockouts can be done using a formula like this.

CS NDOS x AUSPD x PPU CC Where CS Cost of a Stockout NDOS Number of Days Out of Stock AUSPD. Please calculate the cost of common stock by using the dividend discount model. For example if you own three shares in the Stock Basis Calculator app and.

Next it adds the average of 175 to the estimated restock time of seven days which equals 875 days. Operating cash flow per share is calculated by dividing a companys operating cash flow by the number of shares outstanding. To find the cost basis of old stock youll first need to know what you paid for it.

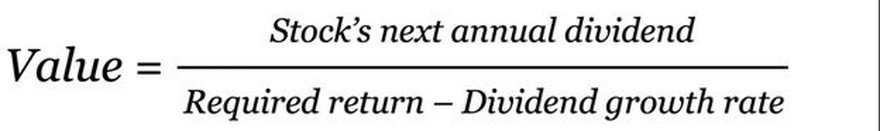

R D1Po g D1 5 Po 100 g 17 r 510017 22. Rp 400 1 20 5000 20 The formula above tells us that the cost of preferred stock is equal. Cost basis refers to the amount paid to buy an asset and extra fees such as commission and transaction cost.

There are a couple of ways you can approach accounting when trying to find the cost basis of old stock. Under this method an estimated cost is found out by pricing the unsold stock at the prevailing selling price less a normal margin of profits plus the estimated. Compute or locate the beta of each company.

To calculate the Beta of a stock or portfolio divide the covariance of the excess asset returns and excess market returns by the variance of the excess market returns over the. Adjusted Selling Price Method. Stock is included in the balance sheet net of VAT.

This task may be simple depending on when you purchased the investment. 7 4 175. The company then divides it by the number of values.

To calculate stock purchases. The formula used to calculate the cost of preferred stock with growth is as follows. Suppose a company give details as on the balance sheet in a financial year of december 31.

150 x 5 - 100 x 5 250 The. First you can use the first. When you liquidate your holding your tax due depends on.

First we need to calculate the growth rate. First we shall calculate the purchase cost. To calculate the cost of multiple shares purchased simply add the individual cost basis for each share you own.

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

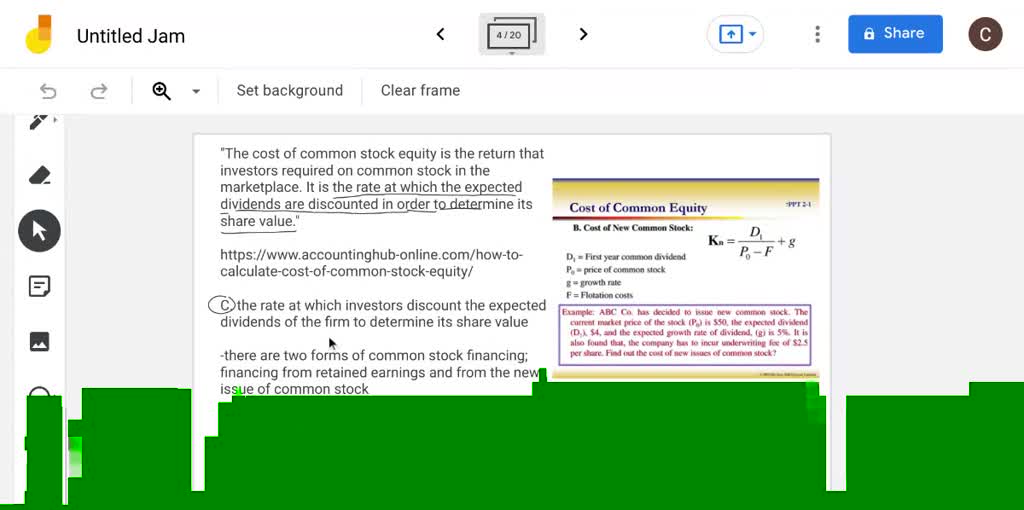

How To Calculate Cost Of Common Stock Equity Accounting Hub

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

Yield On Cost How To Calculate And Apply It

How To Calculate Discount Rate In A Dcf Analysis

Cost Of Preferred Stock Formula And Calculator Step By Step

What Is Safety Stock Definition Importance Formula

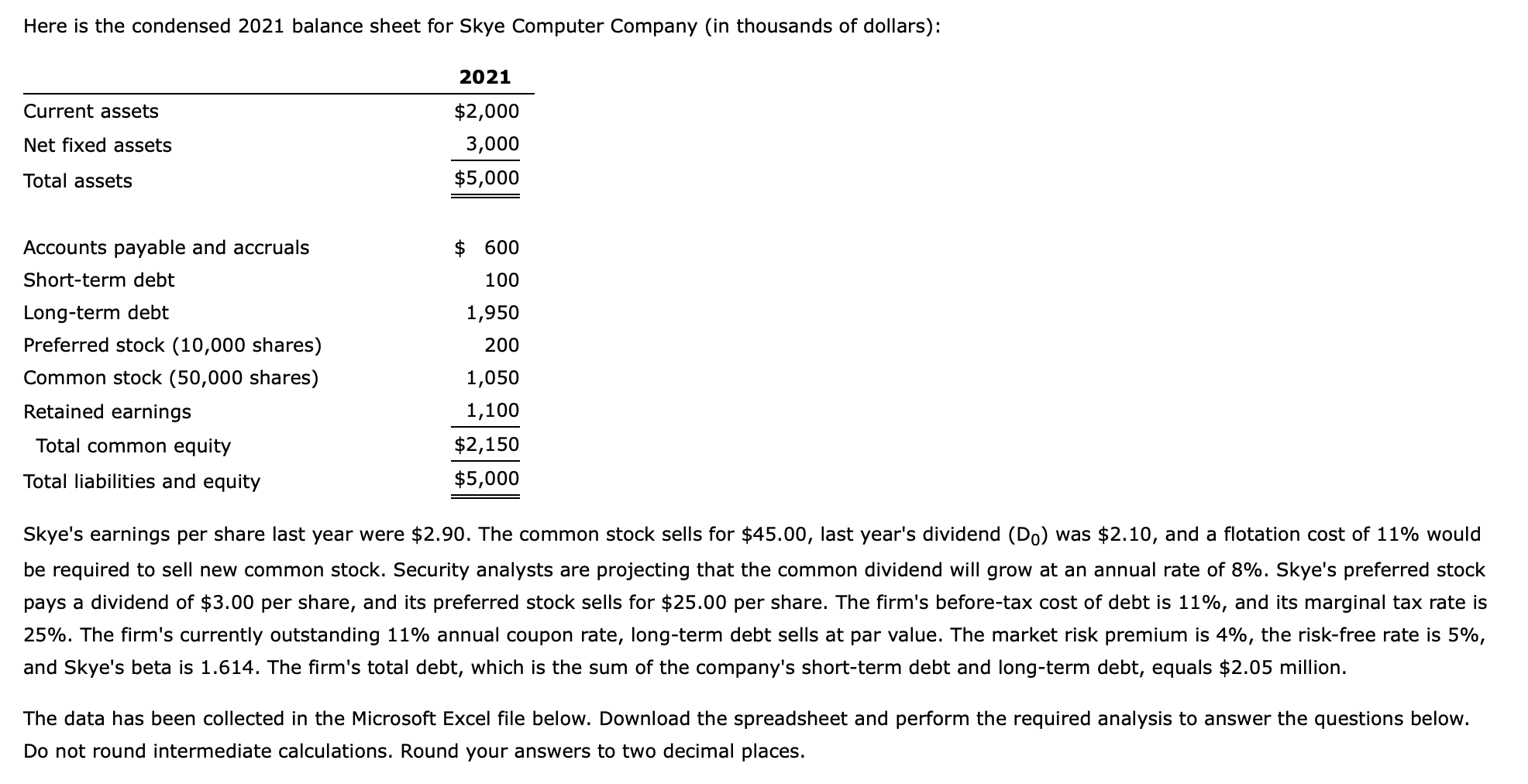

Solved A Calculate The Cost Of Each Capital Component That Chegg Com

Solved I Calculate The Cost Of Each Financing Source For Chegg Com

How To Calculate Weighted Average Price Per Share Fox Business

5 Ways To Define Cost Basis Wikihow Life

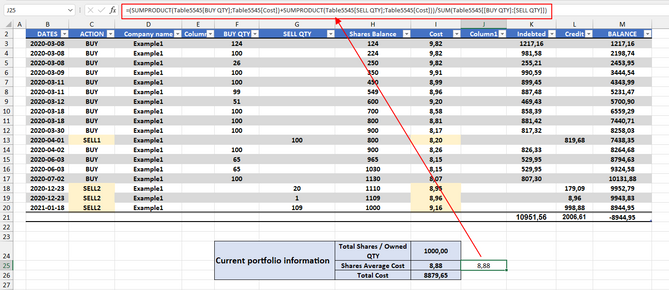

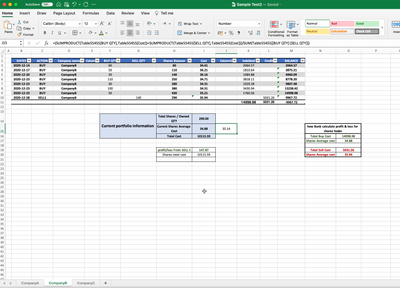

Calculate Profit And Loss And Average Cost For My Portfolio In Stock Market Microsoft Community Hub

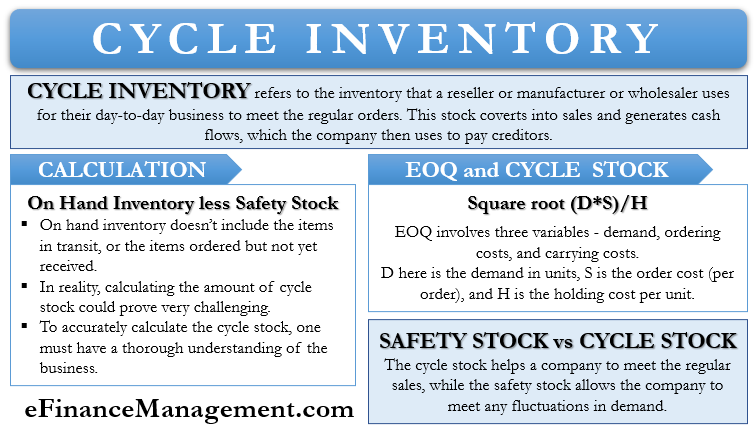

Cycle Inventory Meaning Importance And How To Calculate

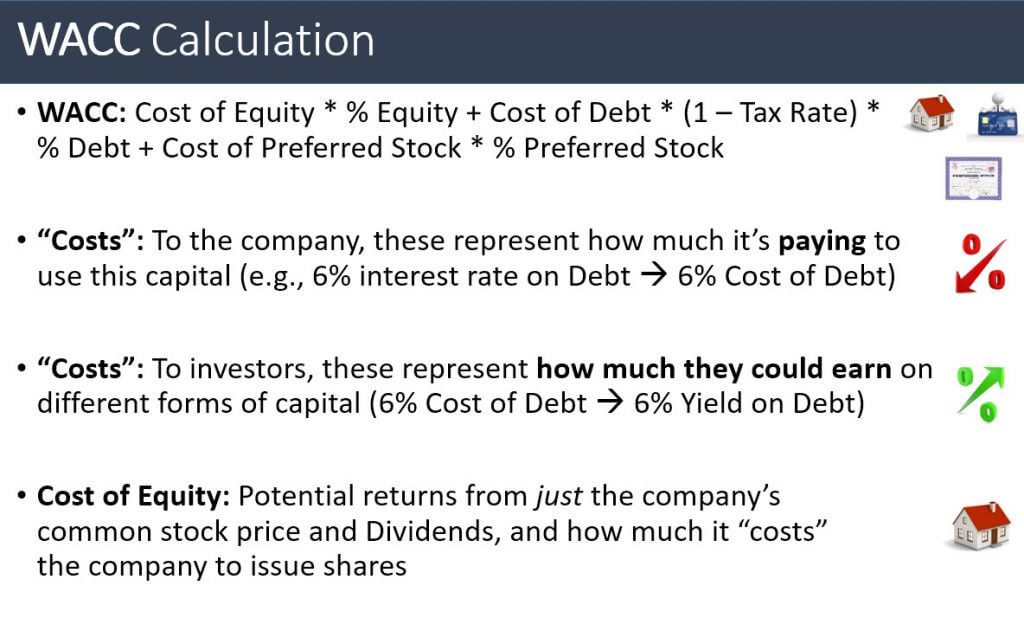

Cost Of Equity Definition And How To Calculate The Motley Fool

Describe How You Would Calculate The Cost Of Common Stock That You Would Use In The Wacc Formula

Using The Data For A Firm Shown In The Following Table Calculate The Cost Of Retained Earnings And The Cost Of New Common Stock Using The Cost Of Retained Earnings Versus Valuation

How To Calculate The Issue Price Per Share Of Stock The Motley Fool

Calculate Profit And Loss And Average Cost For My Portfolio In Stock Market Microsoft Community Hub

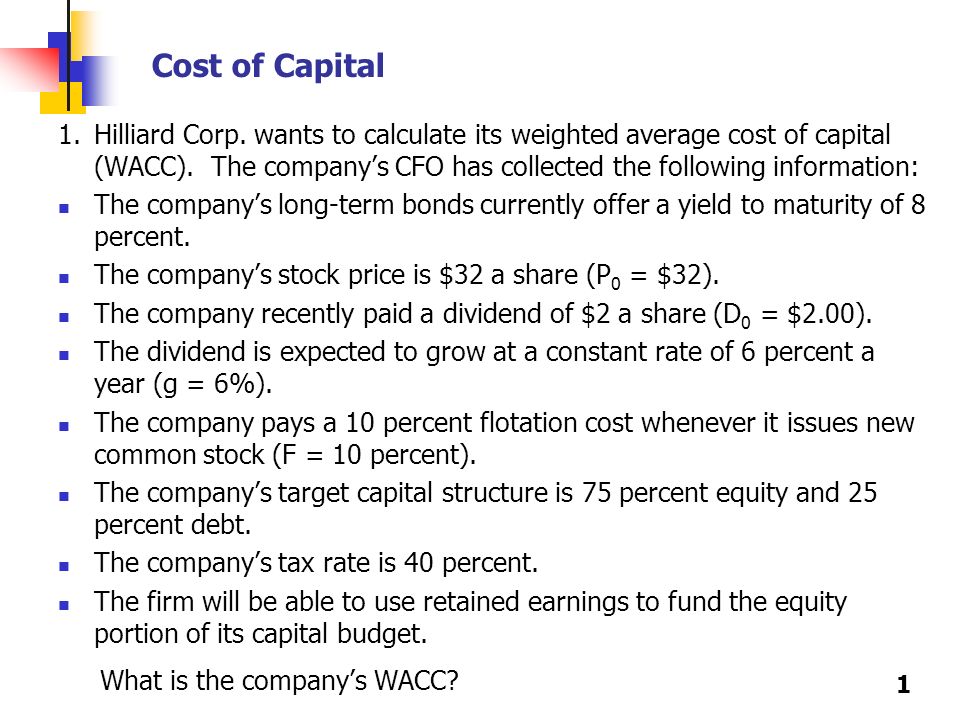

Cost Of Capital 1 Hilliard Corp Wants To Calculate Its Weighted Average Cost Of Capital Wacc The Company S Cfo Has Collected The Following Information Ppt Video Online Download